The members of a Credit Union are also the owners. You have a right to know how the Credit Union is performing, and you are invited to attend the Annual General Meeting where you can contribute to discussions about Credit Union matters and to elect to office people who will have the general good of the membership at heart.

This unique structure ensures that Mitchelstown Credit Union remains focused on the needs of its members which leads to better service for our members.

Benefits……not profits.

Credit Unions earn income by lending the savings of members to other members at reasonable rates of interest. This income covers the expenses of the Credit Union.

As Credit Unions are non-profitmaking organisations, any surplus is channelled into providing members with better products and services, and a competitive return on savings in the form of an annual dividend.

Who can join Mitchelstown Credit Union?

Joining Mitchelstown Credit Union is easy once you are in the common bond and have the relevant documentation.

A member of staff will go through the application process with you. Please allow at least 20 minutes of your time for this.

If you cannot comply with the above requirements please talk to a member of our staff.

Our Credit Union lets people in the community come together to save and borrow money at low rates, and is operated on a not-for-profit basis, with surpluses being returned to members.

Working but not living in the area?

If you are working but not living in the Mitchelstown Credit Union Common Bond and would like to open an account, please also bring with you a letter from your employer or payslip confirming your place of employment.

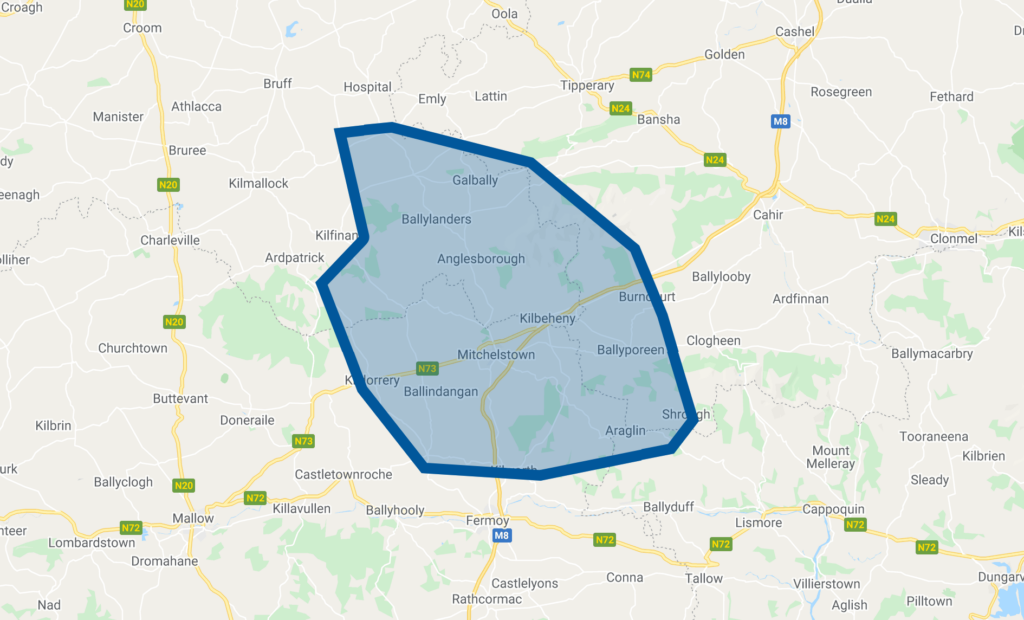

Membership of Mitchelstown Credit Union is open to anyone & their family members who live or work within our Common Bond.

Junior Accounts

To open a junior account (for under 16 year olds), you need: